Pa Vape Laws – How It Shapes the Future of Harm Reduction

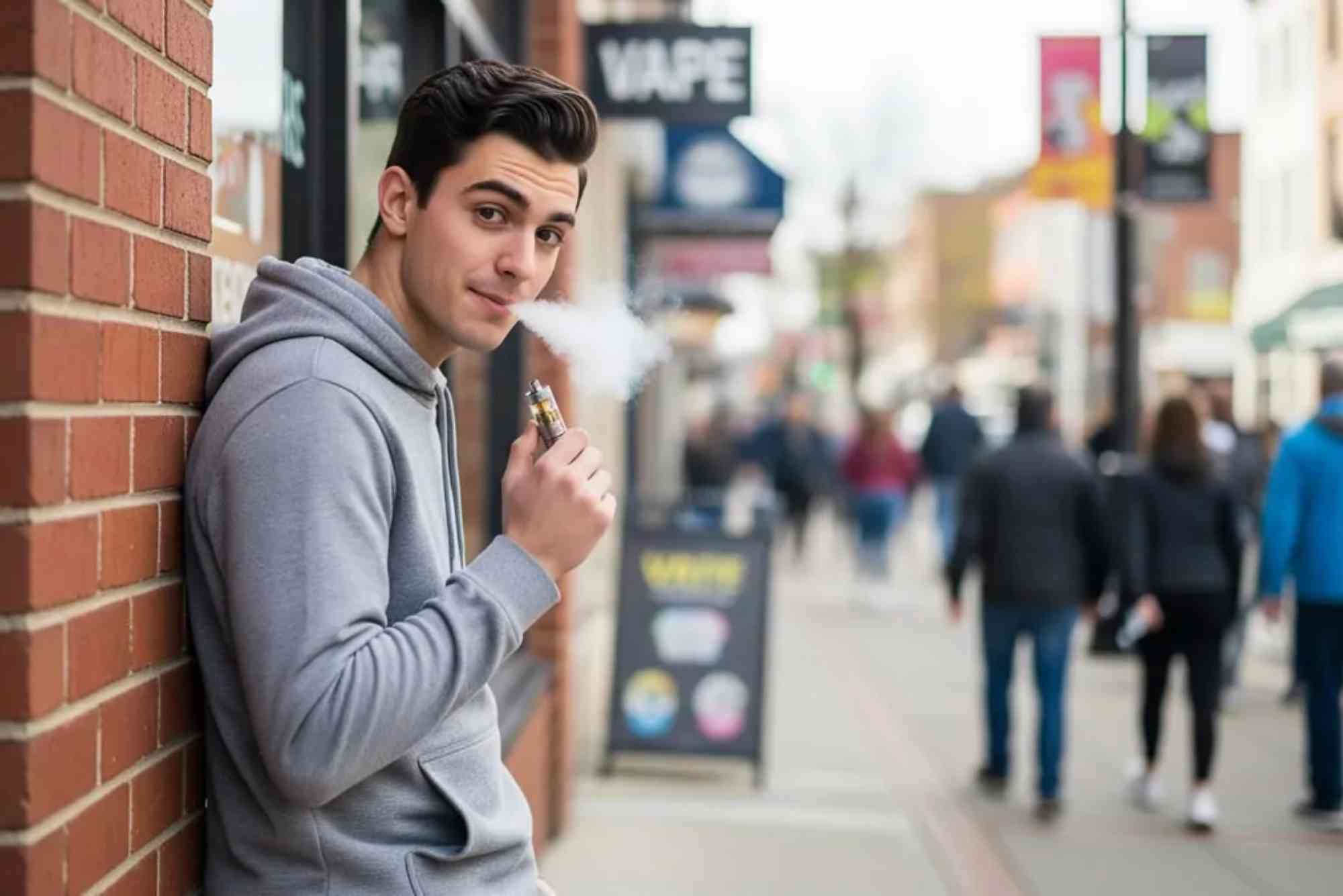

Vaping regulations in Pennsylvania influence not only public health but also the future of harm reduction strategies. As lawmakers respond to rising rates of e‑cigarette use, especially among youth, Pa vape laws are shaping the landscape of tobacco harm reduction and prevention efforts across the Commonwealth. These laws influence retailer behavior, product access, public perception, and the balance between protecting youth and providing alternatives for adult smokers.

Introduction

Pennsylvania’s vaping laws have evolved rapidly over the past decade. What once was a loosely regulated market is now governed by complex statutes that impact public health, commerce, and individual behavior. With the rise in e‑cigarette use among teens and adults alike, policymakers have introduced a mix of age restrictions, taxation, licensing requirements, and usage rules designed to curb youth access while considering harm reduction for adults addicted to combustible cigarettes. Understanding these laws is essential for consumers, retailers, and advocates alike. In this article, we break down the current regulatory environment and discuss how Pa vape laws influence harm reduction and future policy directions.

What Are the Key Components of Pa Vape Laws?

Minimum Age and Youth Protection

One of the cornerstones of Pennsylvania’s vaping laws is the minimum age requirement. No retailer may sell vaping products, including e‑cigarettes and e‑liquids, to anyone under 21. This aligns with the federal Tobacco 21 standard that raised the legal age for tobacco product sales nationwide.

Impact on Youth Access

Retailers must verify a buyer’s age with photo ID for anyone under age 30. Selling to minors is prohibited and subject to fines and penalties. Schools and school property are no‑vape zones, making vaping illegal on school grounds. These age restrictions are intended to reduce youth initiation of nicotine use, which research shows can lead to lifelong addiction.

Licensing and Regulatory Compliance

Pennsylvania requires that businesses obtain a retail license to sell vaping products. Retailers must follow strict rules like keeping vaping products behind the counter and using self‑service controls only in specialty tobacco stores. Penalties for noncompliance can include fines and license suspensions. Compliance checks are conducted regularly to ensure retailers follow state laws and to deter illegal sales to underage individuals.

Taxation on E‑Cigarettes

Vaping products are subject to taxes under Pennsylvania’s Other Tobacco Products tax framework. E‑cigarettes and related products are taxed at a rate of around 40% of the wholesale purchase price. This significant tax has dual goals: to generate revenue and to discourage use, especially among youth. However, high taxes may also influence consumer behavior in ways that affect harm reduction goals, such as pushing users toward cheaper, unregulated products.

Public Use Restrictions

While Pennsylvania’s Clean Indoor Air Act doesn’t explicitly cover vaping products statewide, local ordinances and workplace policies often extend smoke‑free zones to include e‑cigarette use. Some counties and cities have also moved to prohibit vaping in indoor public places where smoking is already banned.

How Pa Vape Laws Influence Harm Reduction

Balancing Youth Prevention and Adult Transition

Harm reduction in tobacco policy is about helping current smokers switch to potentially less harmful alternatives while preventing nicotine initiation among non‑smokers, particularly youth.

Reduced Youth Uptake

Strict age restrictions and licensing requirements aim to limit access for minors, reducing the likelihood they begin using nicotine products. This is a key component of harm reduction from a public health perspective.

Support for Adult Smokers

For adult smokers, vaping products can be a less harmful alternative to combustible cigarettes. However, heavy taxation and regulation might increase the cost and limit accessibility for those seeking to quit traditional smoking. There is ongoing debate about whether current regulations strike the right balance.

Challenges and Market Dynamics

Pennsylvania’s regulatory landscape has had unintended effects. One study noted a significant increase in vape shop openings even after the implementation of a vaping tax, suggesting consumer demand remains strong. However, a notable portion of vape shops operated without proper licensing, highlighting enforcement challenges. Regulations can sometimes push consumers toward unlicensed or illicit markets, undermining public health efforts. When pricing and access become barriers to legal products, consumers may turn to cheaper, unregulated alternatives with unknown safety standards.

Emerging Legislation and Future Directions

Legislation continues to evolve. Recent bills aim to refine how vaping products are regulated, including proposals to create a statewide database of certified vape products to ensure compliance and safety. Critics warn that such measures may favor large manufacturers over small businesses and could have economic impacts on local vape shops.

Increasing Regulatory Transparency

A vape product registry could help enforcement and consumer awareness, ensuring that products sold in Pennsylvania meet legal and safety requirements.

Potential Flavor Restrictions

Some localities have adopted flavor restrictions and limitations on nicotine concentrations in products to address concerns about youth appeal. These measures reflect a broader trend where local and state policies influence harm reduction discussions by targeting products that are particularly attractive to teens.

Challenges Facing Harm Reduction in Pennsylvania

Enforcement Issues

While the intent of Pa vape laws is clear, enforcement can lag. Retailers may unintentionally or intentionally sell to underage buyers, and noncompliance with licensing rules remains a challenge.

Balancing Public Health and Personal Freedom

Regulators must balance public health priorities with individual freedoms. Excessive restrictions could push adult users toward black market products, while lax regulation could foster youth uptake.

Pennsylvania’s approach to vaping regulation reflects a complex effort to protect youth, support harm reduction, and maintain a fair commercial environment. Pa vape laws shape not only what products are available but also how individuals interact with vaping as a harm reduction tool. The state’s evolving legislative landscape, combined with public health goals and economic considerations, suggests that vaping policy will continue to adapt.

If you’re a consumer, retailer, or advocate affected by these laws, staying informed is crucial. Dive deeper into specific statutes like those found in the Pennsylvania General Assembly — vaping statutes & bills to understand how changes could affect you.

Frequently Asked Questions

What is the legal age to buy vaping products in Pennsylvania?

In Pennsylvania, the legal age to purchase vaping products is 21, aligning with federal law that raised the national tobacco sales age.

Are vaping products taxed in Pennsylvania?

Yes. E‑cigarettes and other vapor products are taxed at approximately 40% of the wholesale purchase price.

Can minors use vaping products on school property?

No. Using or possessing vaping products on school grounds is prohibited and considered an offense.

Do vape shops need a license to operate?

Yes. Retailers must be licensed to sell vaping products and must follow strict display and sales regulations.

Will future laws further restrict vaping in Pennsylvania?

Yes, legislative efforts are underway to create product registries and refine marketing and sales rules, which could further shape the market.